Most subscription businesses know that churn rate is an important metric to measure. But very few know what to do with it. Some of the questions we often get are – What is a good churn rate? What is a bad churn rate? What effect is churn having on my business overall?

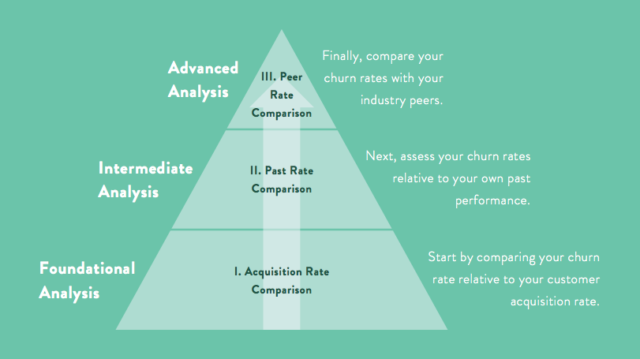

Zuora recognizes the reality that each business is different with its own unique set of circumstances. This has led us to develop what we call the Churn Relativity Framework. The framework will help you interpret what your churn rate means for your business, and how it can guide your growth strategy.

The Churn Relativity Framework is comprised of three pillars that stress the relative importance your business should place in any comparative churn analysis you undertake.

Foundational Analysis: Your Churn Compared to Your Acquisition Rate

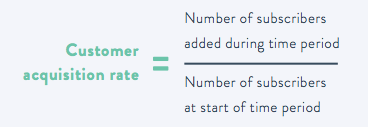

The first step in assessing your churn rate is to compare it with your customer acquisition rate. Customer acquisition rate is defined as the number of new customers added (over the same period churn is being measured) divided by the number of customers you had at the start of that period.

For example, if your business added 50 subscribers in a month and the month started with 1000 customers, then:

Customer acquisition rate = 50 / 1000 = 5%

Similar to churn rate, the formula above does not dictate a time period (monthly, annual). But make sure you use consistent time periods when comparing your acquisition and churn rates.

Comparing churn rate to customer acquisition rate is important because it breaks down your overall customer growth rate into its two primary components. It helps you assess whether your churn rate is sufficient to fuel exponential customer base growth, if your churn rate will lead to accelerating customer base contraction, or something in between.

Assuming you have a steady or growing business, there are likely three different states you might find yourself in:

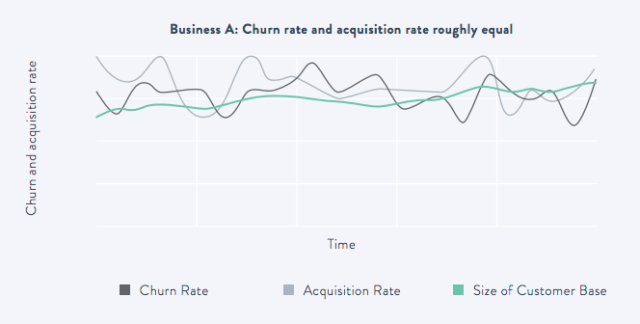

State 1. Subscription Equilibrium: Subscription equilibrium occurs when your churn rates and acquisition rates have been trending roughly equal to one another, as illustrated below.

Over time, the business starts and ends with roughly the same number of customers. The business is flat. In this situation, the size of your customer base stays relatively unchanged — no growth, no loss.

Subscription Equilibrium is a delicate time for a business because slight fluctuations in either acquisition or churn can tip the business into growth or attrition.

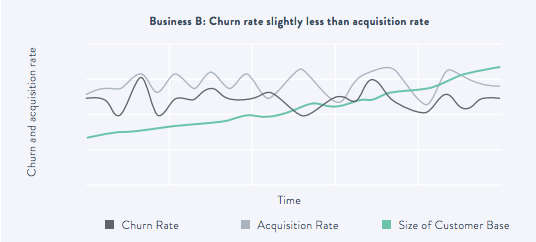

State 2. Subscription Growth

The next chart illustrates subscription growth, a state of your business that occurs when acquisition rates are slightly greater than churn rate.

State 3. Subscription Acceleration

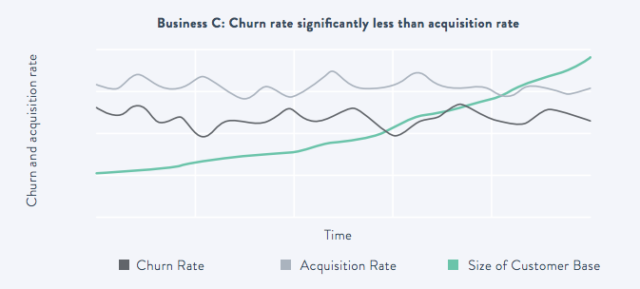

All companies in the Subscription Economy want to be in state 3 – Subscription Acceleration. The chart below illustrates this state — it occurs when the rate of customer acquisition substantially outpaces churn rate.

While acquisition and churn rates are flat over time, since acquisition is steadily trending ahead of churn, the business experiences an accelerating customer growth curve. The greater the delta between acquisition and churn, the more dramatic a “hockey stick” shaped growth chart the business will yield.

These illustrations should encourage you to ask yourself two strategic questions about your business:

1. How has churn and acquisition rates for my business trended over history?

2. What impact have they had on the growth of my customer base?

When looking at these charts, keep in mind this important data point – Industry studies estimate the cost of acquiring one new customer at 5-25x greater than the cost of retaining one existing customer.

Consider that when you are debating whether you should increase acquisition or reduce churn rate to get your business to Subscription Acceleration — it is quite likely that customer growth fueled by reducing churn will be much more cost efficient for your business than customer growth fueled by increasing acquisition.

To learn how to do more in-depth and advanced analysis of your churn rate, download our ebook – Measuring and Assessing Subscriber Churn